Estimate net income

The 1040 income tax calculator helps to determine the amount of income tax due or owed to the IRS. State and Local Taxes.

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Gross receipts 20000 COGS 12000.

. Learn about self-employment. The value of total net investment losses. If your parental income in the current tax year is substantially less perhaps by 25 Centrelink may use your estimate for the current tax year.

Total investment income for the quarter ended June 30 2022 was 1846M exceeding the 1766M average analyst estimate and increasing from 1814M in the prior quarter and from 1573M in the. It is an estimate based on. If income has changed or may be hard to estimate.

The second estimate for the second quarter based on more complete data will be released on August 25 2022. Your net income from self-employment is what you report on Schedule C of your federal tax return. Estimate the Tax You Will Owe on Retirement Income.

The drop in income needs to be likely to continue for 2 years eg. Net income is sometimes called profit If your self-employment income is higher than your business expenses you report this net income. Write down the net expected income for coverage year or download and save the PDF.

It is the total of. If your business expenses are higher than your income you report a net loss. Farm gross income 27000 Total expenses 8500 Net farm profit 18500 Julies business income Schedule C.

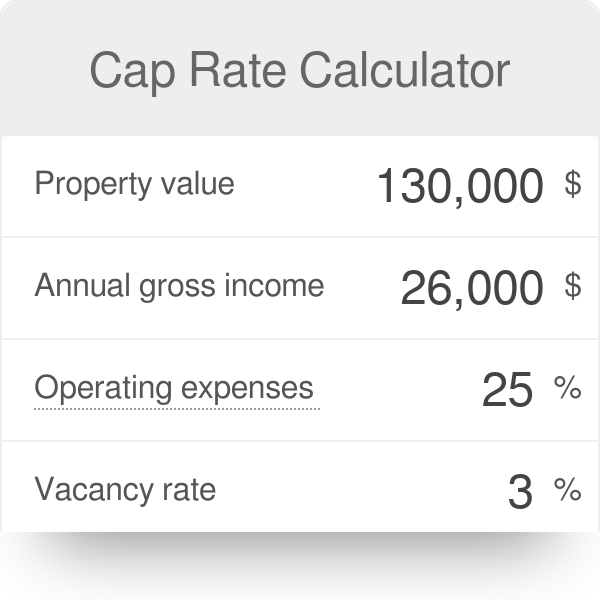

Finally we can estimate our net income. The cost of attendance. To calculate the cap rate divide the NOI by the market value or selling price of a property.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency refer to Source Data for the Advance Estimate on page 3. In the calculation above dividing your net income by 1 minus your expected tax bracket will tell you the amount of gross income you will need in order to pay your taxes and meet your other expenses. If youll file as a part-year resident in 2021 estimate Oregon tax on all income for the part of the year that youll be a resident and in the same manner as a nonresident for the.

The estimate provided using this calculator does not represent a final determination actual award of financial assistance or a final net price. Ascertain if the investment earns enough to cover any loans. Click here for a 2022 Federal Tax Refund Estimator.

The self-employment tax rate is 153 of your net business income and it includes. Earnings statements W-2 forms recent paycheck stubs. Use this number to compare the investments income to other properties.

When filling out your application youll be shown the expected yearly income. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Gross receipts 20000 COGS 12000.

Because of retirement although you need to include retirement benefits in calculating income. It may be necessary to refer to the students and parents most recent federal tax returns in order to complete the form accurately. The Net Price Calculator provides a more detailed estimate using more information about your familys finances and Yales current aid policies.

Our current financial aid policies and initiatives. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

A needs analysis conducted from income asset and household information. Federal Income Tax Calculator 2022 federal income tax calculator. Farm gross income 27000 Total expenses 8500 Net farm profit 18500 Julies business income Schedule C.

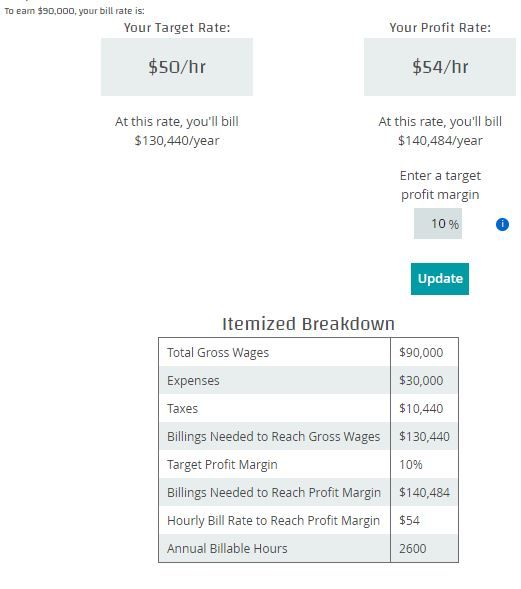

For the accountants reading this - were going to assume we dont need a loan to roll out this new business and ignore the impact of taxes to. The private sector lender reported a 21 percent rise in net interest income to Rs 9384 crore exceeding Streets estimate of Rs 91866 crore. Taxable income also known as adjusted taxable income reportable fringe benefits.

See Ford Motor Company F stock analyst estimates including earnings and revenue EPS upgrades and downgrades. Expenditure Method Expenditure method measures national income as aggregate of all the final expenditure on gross domestic product in an economy during a year. It is designed to provide a first look at what a family can expect to pay.

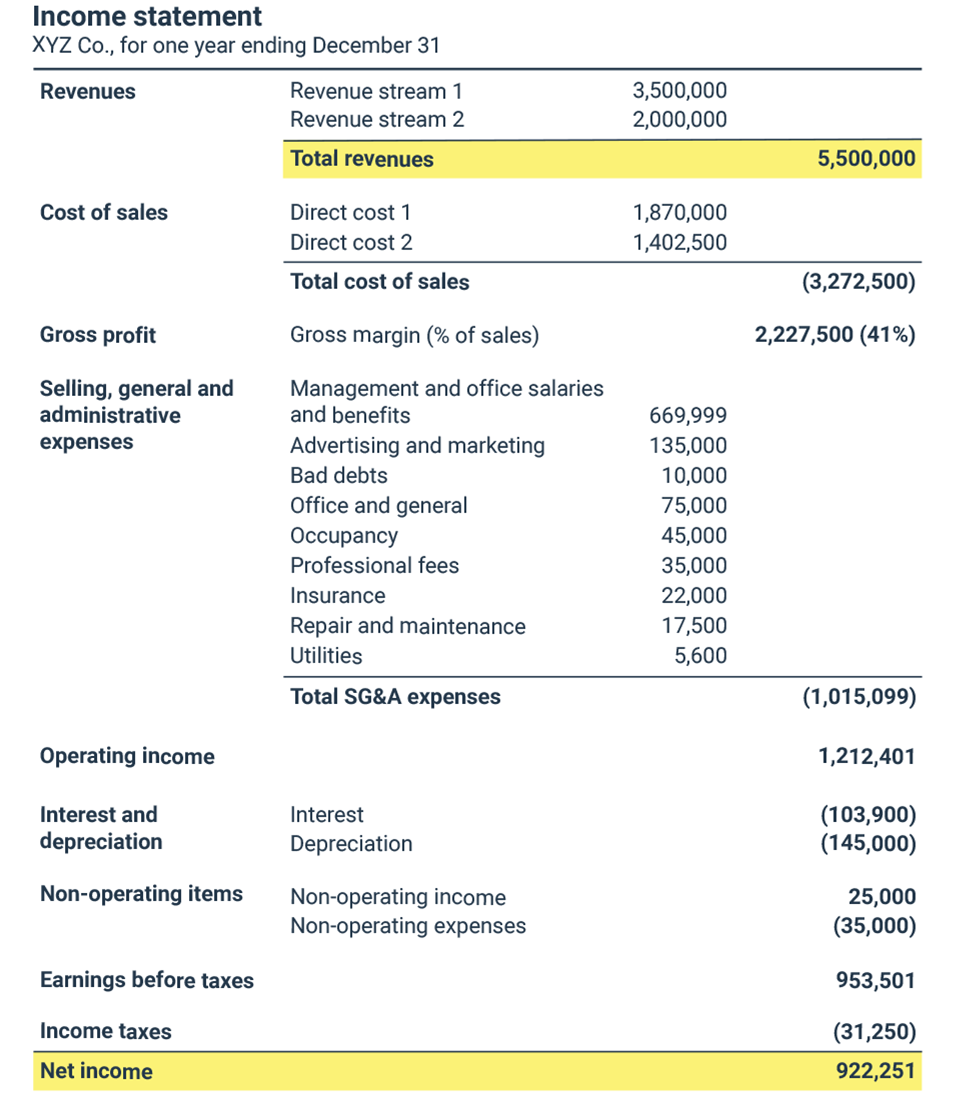

What is a Debt-to-Income Ratio. What to do next. Net Operating Income Gross Operating Income 64800 Other Income1000 - Operating Expenses 15000 Net Operating Income 50800 annually.

In real estate net operating income NOI is the total income of a revenue-generating property minus the total operating expenses. High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited deductions and phased-out exemptions not shown here in addition to paying a new 396 tax rate and 20 capital gains rate. Net Price Calculator For a more in-depth estimate use our Net Price Calculator.

Net expected income for coverage year 000. Please note that if your familys total income is under 60000year the Net Price Calculator will provide a more accurate estimate of your cost. Undefined said Thursday its second-quarter net income fell to 126 billion or 184 a share from 145 billion or 204 a.

If youll file as a part-year resident in 2022 estimate Oregon tax on all income for the part of the year that youll be a resident and in the same manner as a nonresident for the. Is a measure of the net income of. Learning how to estimate quarterly income tax for 1099 contractors and keeping organized enough to do it are just part of that.

Cap rate or capitalization rate is used to estimate the return on investment for a cash flow property. Honeywell International Inc. The income estimate is made up of your or your and your partners taxable income for the current financial year from 1 July to 30 June.

As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48. If the amount shown is different than this amount select No. Changes to Income.

The Net Price Calculator is a comprehensive calculator that asks a number of detailed questions to calculate an estimate of the amount your family may be expected to contribute. You can also estimate your tax refund if applicable. Taxhub enables you to consult online with a CPA throughout the year.

Student and Parent Income Tax Returns. Add Net factor income from abroad in Net Domestic Product at Factor Cost to obtain Net National Product at Factor Cost NNP at FC or national income. Based on this NOI calculation an investor can then.

Net Profit Ratio Double Entry Bookkeeping

Net Revenue Definition Formula How To Calculate Net Revenues

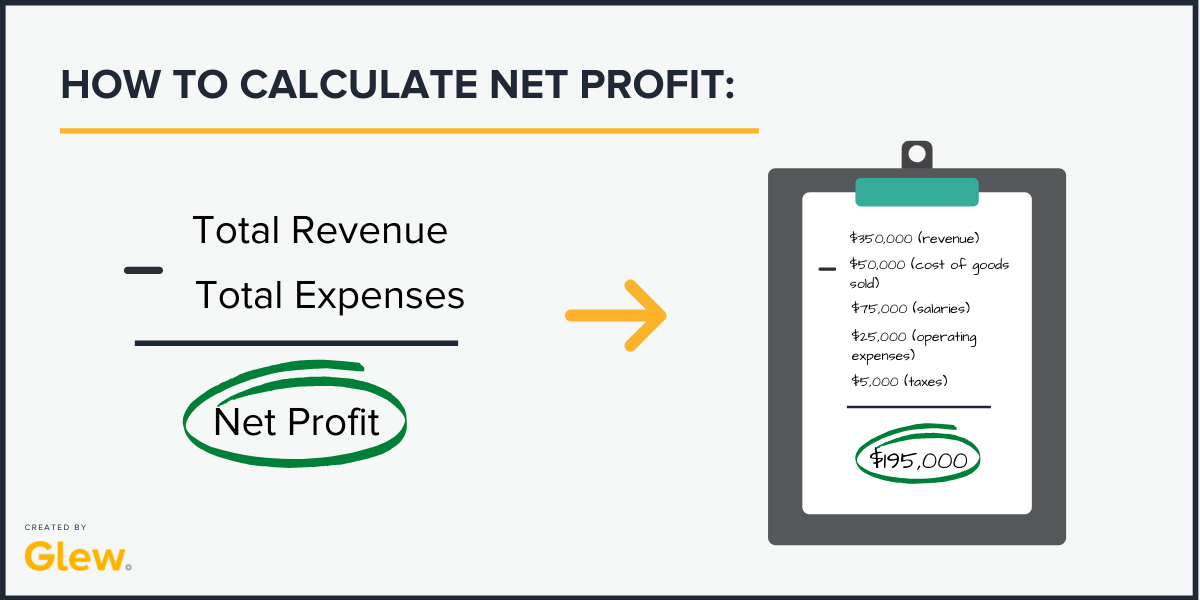

What Is Net Profit And How To Calculate It Glew

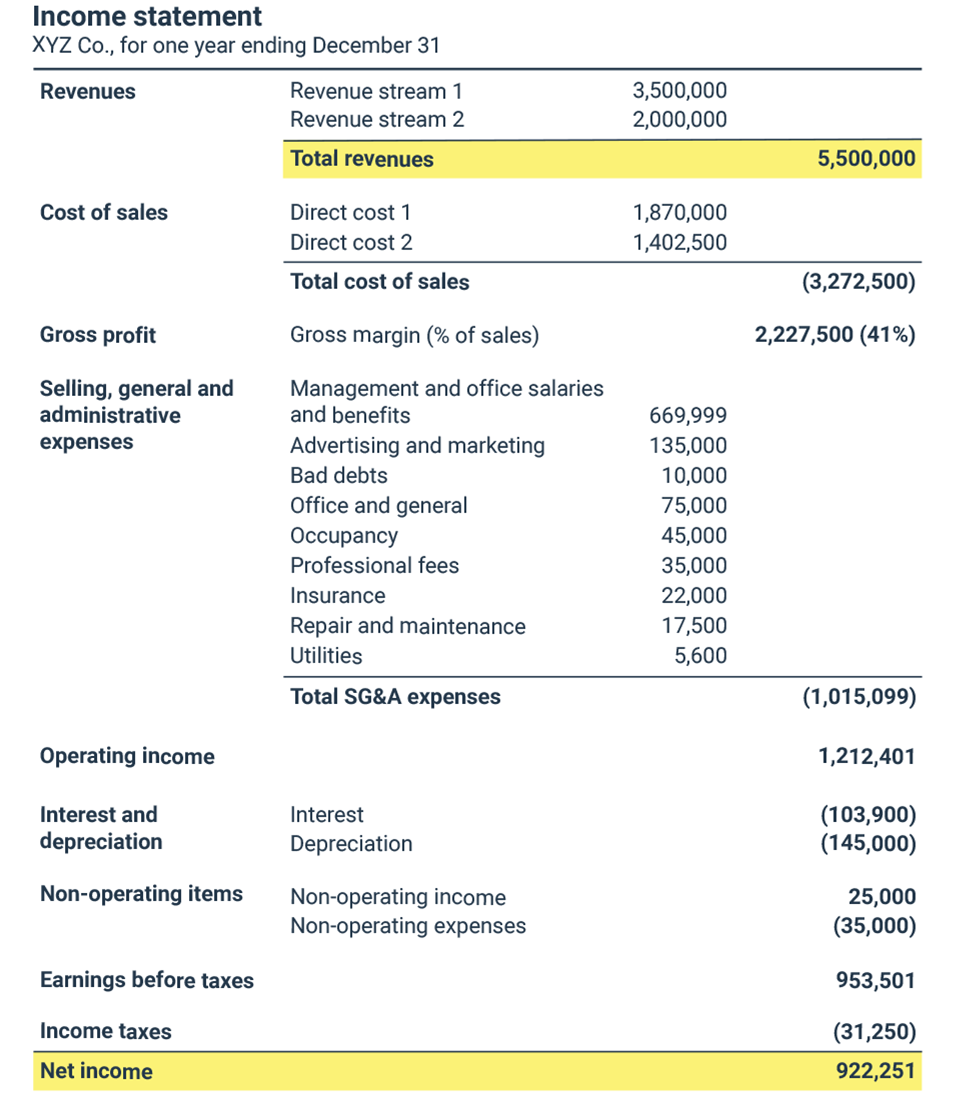

How To Calculate Net Income Formula And Examples Bench Accounting

Net Worth Calculator Find Your Net Worth Nerdwallet

Net Income Formulas What Is Net Income Formula Examples

How To Calculate Net Income Formula And Examples Bench Accounting

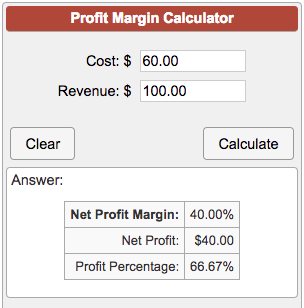

Profit Margin Calculator

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

What Is Net Profit And How To Calculate It Glew

Net Income Formula And Calculation Example

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Net Profit Margin Calculator Bdc Ca

Cap Rate Calculator

Gross Profit Margin Vs Net Profit Margin Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income