37+ home mortgage interest tax deduction

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US.

Typical Mortgage Payment To Climb More Than 50 Bmo Economist R Canada

Taxes Can Be Complex.

. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web You can deduct your mortgage interest only on the first 750000 of your loan. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Even if you didnt get your home mortgage interest deduction on Schedule A because you didnt have enough itemized deductions to exceed your standard. Web If you took out your mortgage on or before Oct.

Also if your mortgage balance is. Web 1 hour agoThe credit is available to those with adjusted gross incomes AGIs of up to 73000 for married filing jointly 54750 for heads of household and 36500 for others. 25900 for married couples filing jointly.

Original or expected balance for your mortgage. This deduction is capped at 10000 Zimmelman says. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

Web Some TurboTax customers may be experiencing an issue because TurboTax isnt allowing qualified customers to deduct the full amount of their home mortgage interest. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Expired tax benefits.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. 13 1987 your mortgage interest is fully tax deductible without limits.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Homeowners who bought houses before.

Taxes Can Be Complex. Web The standard deduction for the 2022 tax year is. Web What portion of mortgage interest is tax deductible.

For taxpayers who use. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. The deduction for mortgage insurance premiums treated as mortgage interest under section 163h3E and formerly reported on lines 10 and 16.

Ad Questions Answered Fast. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Enter your address and answer a few questions to get started.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Taxpayers can deduct the interest paid on first and second mortgages up to.

Homeowners who are married but filing. So if you were dutifully. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Get 1-on-1 Tax Answers Online Save Time. If you bought your house before December 15 2017 you can deduct the interest. Web IRS Publication 936.

Households claiming the home mortgage interest deduction declined. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. 12950 for single filers and married individuals filing separately.

Learn More At AARP.

The Home Mortgage Interest Deduction Lendingtree

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deductions Tax Break Abn Amro

10 Steps Toward Home Ownership Mortgage 1 Inc

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction What You Need To Know

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

American Economic Association

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

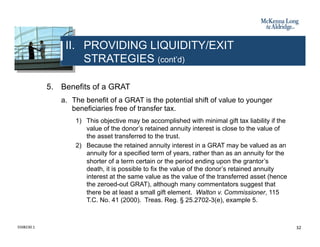

Business Succession Planning And Exit Strategies For The Closely Held

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

What Expenses Can Be Deducted From Capital Gains Tax

Mortgage Interest Deduction A 2022 Guide Credible